We are growing slowly, but a mistake caused our costs to explode. Welcome to our Open Startup Report for January 2024.

Contents

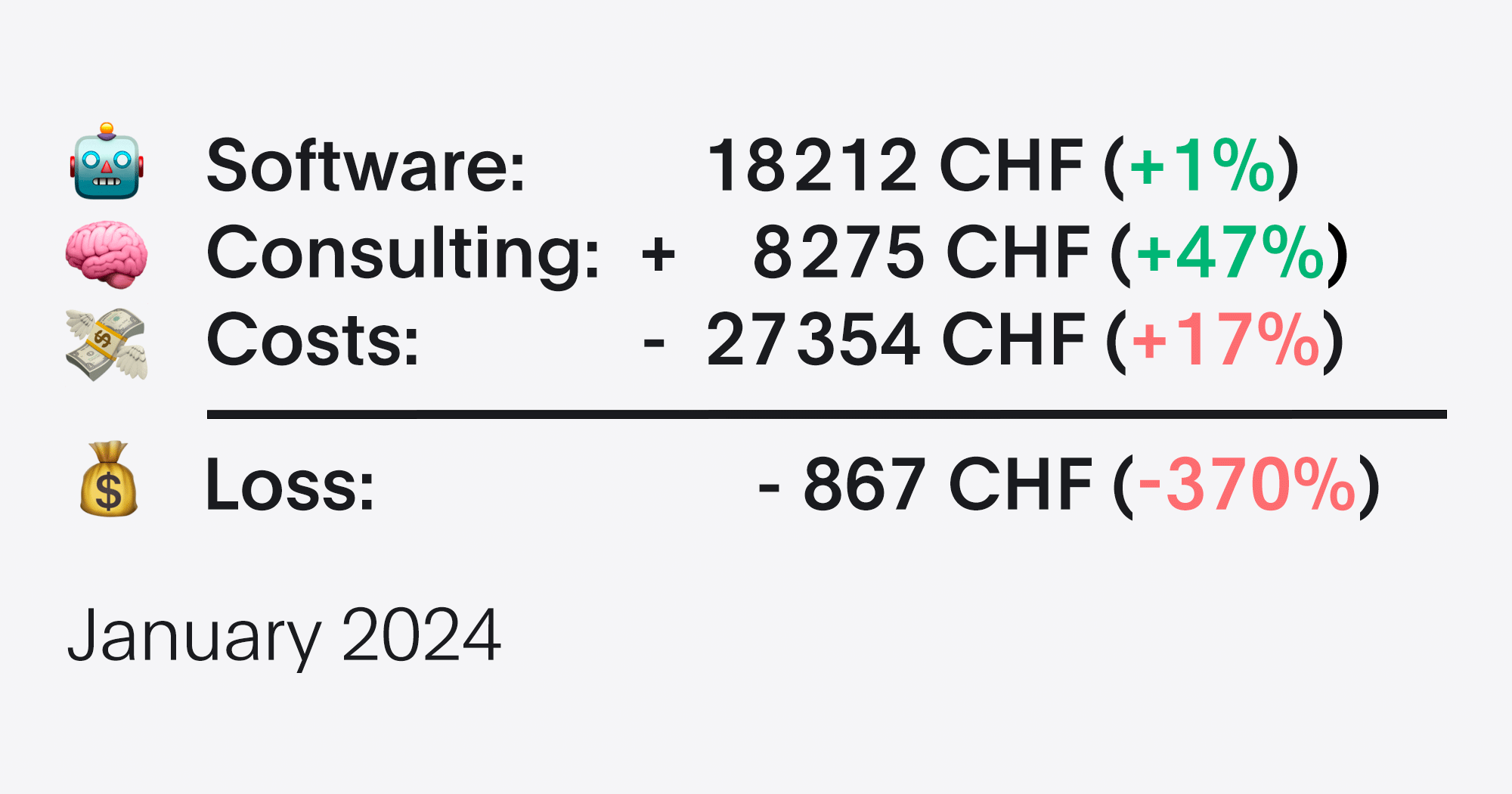

January at Friendly in Numbers

- 🤖 Software revenue: 18 212 CHF (+1%)

- 🧠 Consulting revenue: 8 275 CHF (+47%)

- 💰 Total revenue: 26 487 CHF (+12%)

- 💸 Costs: 27 354 CHF (+17%)

- 🧾 Profit and loss: -867 CHF (-370%)

- 👩 Active customers: 122 (+2%)

- 💔 Churn rate (lost customers): 0.8% (-50%)

- 👋 New trials: 14 (+27%)

- 🔎 Website visits: 4 229 (+12%)

These were the key developments in January:

Revenues: Slow growth in software sales, good result in consulting

Our monthly recurring revenue (MRR) from software subscriptions rose by just CHF 190 to CHF 18 212 in January, an increase of 1% on the previous month.

As our software subscriptions form the basis for consulting, they are the decisive growth factor for our company. The figures for the last few months show: We are growing slowly – but steadily.

And that is okay. Our company is growing healthily, we are continuously improving our quality and we are providing everyone in the team with a solid foothold in life. Not only financially, but also through a balanced working environment in which we do well in the long term.

Our customer numbers are also currently very stable. In January, we lost one customer and gained two new ones, so we currently have 122 customers.

This month, consulting turnover rose by a full 47% to CHF 8 275. The largest projects were assignments for an insurance company, a construction machinery dealer, a bank and a non-profit organization. We assisted with the design of newsletters, set up enterprise instances and provided employee training.

Our total revenue in January was a good CHF 26 487, an increase of 12% compared to December.

Costs: Costs explode due to freelancers and high advertising expenses

By contrast, our costs rose massively in January: from CHF 23 338 in the previous month to CHF 27 354.

The main reason for this was a consulting project that we covered with a freelancer. This project resulted in unforeseeable expenses that we were unable to charge directly to the customer and therefore had to bear ourselves.

I see these one-off costs as an investment in the customer relationship with an important customer. And as a lesson learned. I miscalculated and evaluated the mistake so as not to repeat it.

In addition, our advertising costs in search engine advertising also increased. This increase was directly caused by higher demand for our products on Google and Bing, and I am therefore very pleased with it.

Here are all our costs including salaries for January 2024 in detail:

Open Startup: Does it make sense?

We don’t just run from one success to the next. We grow slowly and make mistakes. And we also share these things in our Open Startup Reports. We are regularly asked if this is “necessary”.

I recently shared my motivation on indiehackers.com:

Marketing and visibility

“We benefit by getting attention. Our monthly open startup reports do very well on LinkedIn because being open is still novel in Switzerland, our home market. We are still the first and only “open startup” in Switzerland.”

Trust

“It creates trust because people see that their fees actually are invested into the product; not into the CEO’s Lamborghini.”

Feedback

“We often get valuable feedback. For example, people questioned our hosting costs and pointed us to better options.”

To summarize – we’ve had positive experiences with it. Others see it differently. Read more in the article on indiehackers.com.

Conclusion

The result of the good revenue figures and the high one-off costs on the other side: the new year starts with a narrow loss of CHF -867.

This is uncomfortable after we had already reached the “black figures”* quite reliably last year.

But it’s also manageable because we understand why it happened.

I expect that we will be able to sustainably consolidate our financial situation this year.

* “Black figures” is deliberately put in quotation marks because I have not yet paid myself a salary for my work and, as a sole founder without investors, I have yet to make up for the loss so far.

Friendly in your inbox? Sign up for our newsletter.