Things have been moving forward since we expanded our consulting services: this month was even better than the last. Welcome to our Open Startup Report for March 2024.

Contents

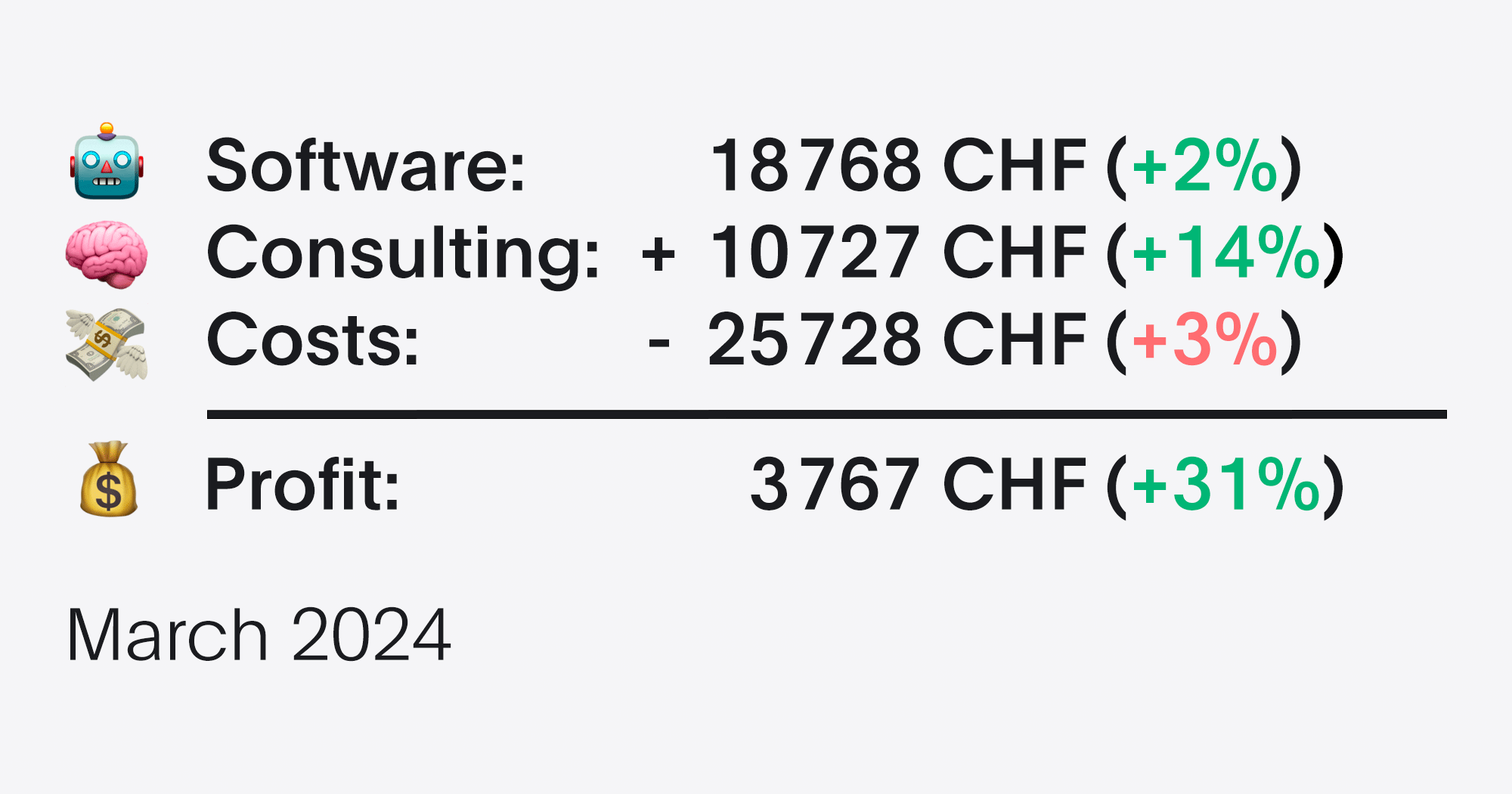

March at Friendly in Numbers

- 🤖 Software revenue: 18 768 CHF (+2%)

- 🧠 Consulting revenue: 10 727 CHF (+14%)

- 💰 Total revenue: 29 495 CHF (+6%)

- 💸 Costs: 25 728 CHF (+3%)

- 🧾 Profit and loss: 3 767 CHF (+31%)

- 👩 Active customers: 126 (+2%)

- 💔 Churn rate (lost customers): 1.6% (-34%)

- 👋 New trials: 8 (-50%)

- 🔎 Website visits: 3 206 (-13%)

These were the key developments in March:

Revenues: Software sales rise slowly, consulting on an upward trend

Our monthly recurring revenue (MRR) from software subscriptions rose by 2% or around CHF 300 to CHF 18 768 in March. This is the ninth consecutive month of reliable growth in software sales.

Consulting turnover continues on an upward trend. At CHF 10 727, we exceeded the CHF 10 000 threshold for the fourth time, following successful consulting months in June, September and November 2023. Compared to the previous month, we achieved a 14% increase in consulting turnover.

This is systematic: we are investing more in consulting, as we are active in the B2B sector with our software and are increasingly reaching larger customers who need customized software solutions.

Thanks to the technical and professional expertise of our CCO Lukas Sigel and CTO Joey Keller (Friendly Automate) and our “permanent freelancer” Peter Boehlke (Friendly Analytics), we can offer these customers personal support and individual solutions.

Our customers request our team to be available for these important services and appreciate the fact that we have reliable contacts on site.

Meanwhile, the number of our active customers rose by +2% to 126, while the churn rate fell to a good 1.6%.

Thanks to the very good result in consulting, our total turnover rose by +6% to CHF 29 495 in March.

This result puts us 48% above the total turnover in the same month last year (March 2023).

Costs: Slight increase in salary costs due to salary increase and exchange rate fluctuations

Our salary costs rose by around CHF 600 in March. This was partly due to exchange rate fluctuations: We pay Joey’s salary in euros. In Swiss francs, his salary cost us around CHF 100 more this month than in February.

At the same time, Lukas was able to increase his workload at Friendly from 35% to a (permanent) 40%. This is a long-term gain for us. Lukas supports our most important customers in a friendly and professional manner. Examples of this are Branchen Versicherung and the pharmaceutical company Pierre Fabre, with whom we recently published two case studies.

Our advertising costs fell slightly in March in line with normal fluctuations, while most other cost factors remained constant.

There was a one-off cost for Stefan’s participation in a marketing event, at which he developed his knowledge and made new contacts.

Here are all our costs including salaries for March 2024 in detail:

Founded writes about Friendly

The Founded magazine reports on the startup ecosystem in Switzerland. They recently published an article about Friendly (in german language). It discusses our beginnings, our goals and what is important to us.

Founded calls Friendly “exemplary for a new generation of software companies that not only drive technological innovation, but also take social responsibility seriously and lead the way”.

Conclusion

The result in March: we achieved a “profit”* of CHF 3 767, an increase of another 31% compared to the good previous month of February.

This is the first time in our history that we have achieved two very good results in succession. And all the signs indicate that the upward trend will continue in the coming months.

* “Profit” is deliberately put in quotation marks because Stefan has not yet paid himself a salary for his work at Friendly and, as a sole founder without investors, he has yet to make up for the loss so far.

Friendly in your inbox? Sign up for our newsletter.