We get asked time and again why we don’t want investors at Friendly as a tech startup. It’s not that we haven’t received any offers yet. But we have turned them all down and will continue to do so in the future. For good reasons:

Contents

Investors increase risk of failure

Many people think that investors increase the odds of long-term success. The opposite is the case. It’s a gamble where very few startups win. Most go bankrupt precisely because of the investments they receive. But why is that?

An outside business investment usually means you’re “setting a time-frame on your existence”.

Jason Fried, Basecamp

Investors want the highest possible return on their investment. This is usually only possible in two ways:

- The startup they invested in makes a successful “exit,” meaning it is sold to another company for a high price (rare)

- The startup goes public and legacy investors can sell their shares at a profit (super rare)

The problem is: both variants require immensely fast growth, and that is usually only possible with a lot of capital.

This takes not one, but often up to six (or more) investment rounds, known in the jargon as “Series A” to “Series E”. And in each of these rounds of capital increases, many startups go bankrupt because they cannot find enough new investors who are willing to inject additional capital at an even higher valuation.

Of all startups that made a first investment round (“called a seed round”), only 3% of all startups manage to get a sixth round of capital (“Series E”), according to a study by CBS Insights (2018). 1% of the startups became a unicorn (= valuation above USD 1 billion). 10% of the startups achieved an exit (114 out of 1,1119).

This figure is in line with other studies, such as by Crunchbase (2021). There, only 2% of all startups with seed financing make an exit:

So as soon as we get investor money, we are under pressure to grow as fast as possible. Fast growth comes at the expense of profitability. So we “burn” money in the hope of finding more investors in time before the money runs out.

According to studies, this goes wrong in 90% to 98% of all cases! Instead of growing more slowly under our own steam and spending only what we earn, we massively reduce the survival risk of our company.

In case of failure, this leads to very unpleasant consequences for our employees and our customers, who would have to look for a new job respectively would have to laboriously migrate their data to another software.

Investors reduce entrepreneurial freedom

Personally, I didn’t leave one boss (employment) behind just to get a new boss (investors).

Without investors, we can make decisions that are best for our employees and customers – instead of focusing everything on the fastest possible growth.

We want our employees to receive significantly more paid vacation than the Swiss average? We can do that.

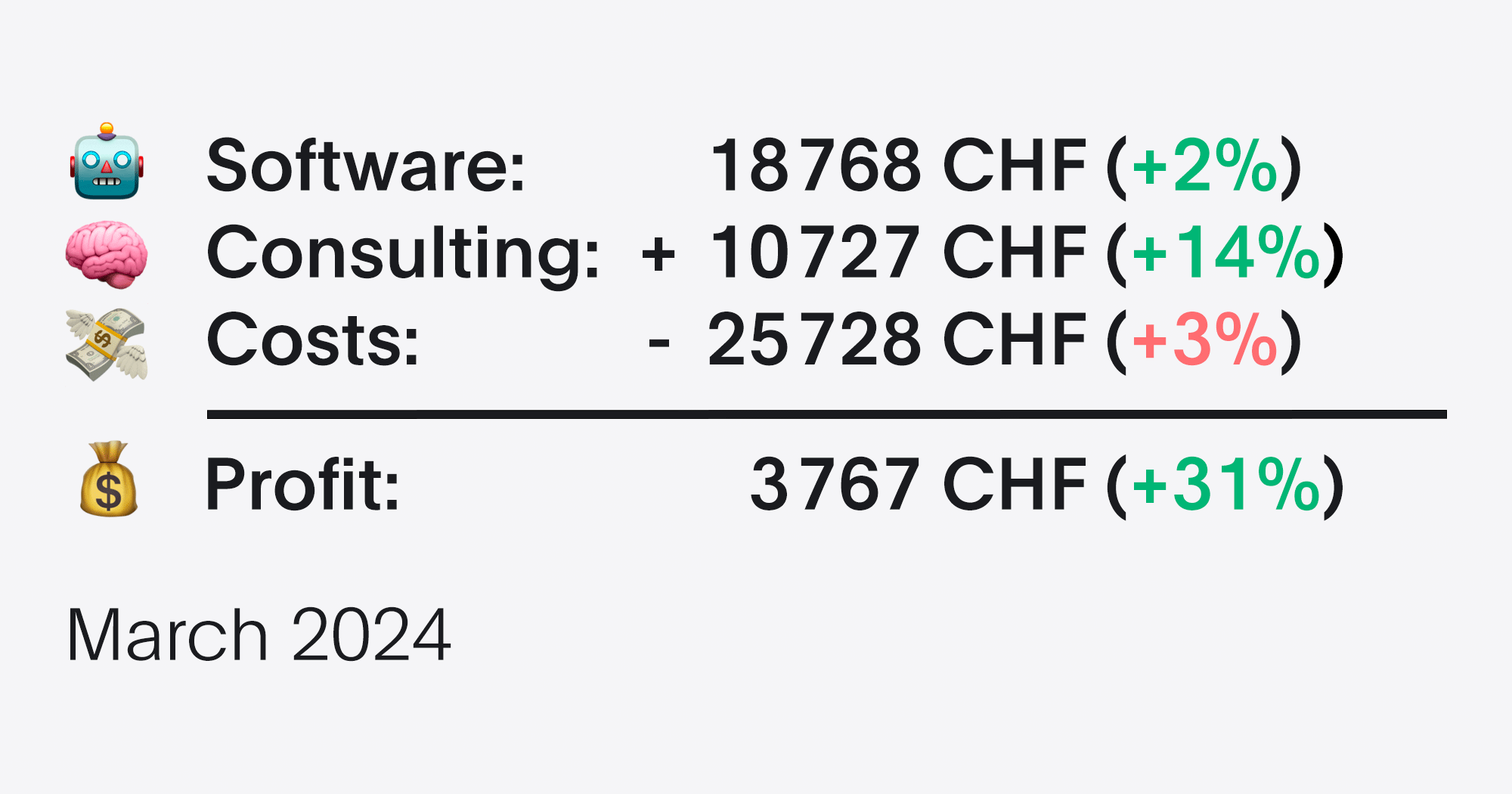

We want to publish all our key figures, such as revenues and costs, to serve as a realistic role model for other entrepreneurs? Our decision alone.

And above all, we choose not to spend more than we earn, if possible. Our next big goal is to reach the black.

In the long term, this provides more security than the largest investment round. I prefer to have less money from many customers than a lot of money from a few investors.

Exits are almost always bad for the team and the customers

Yes, there are cases where an exit (a sale of the company) brings benefits to all involved: the team gets an exciting new employer, the customers get a better service, and the founders get a pile of cash.

Most of the time, however, this is not the case. Employees quit in frustration because the work culture under the new owner has become significantly worse – or they are terminated.

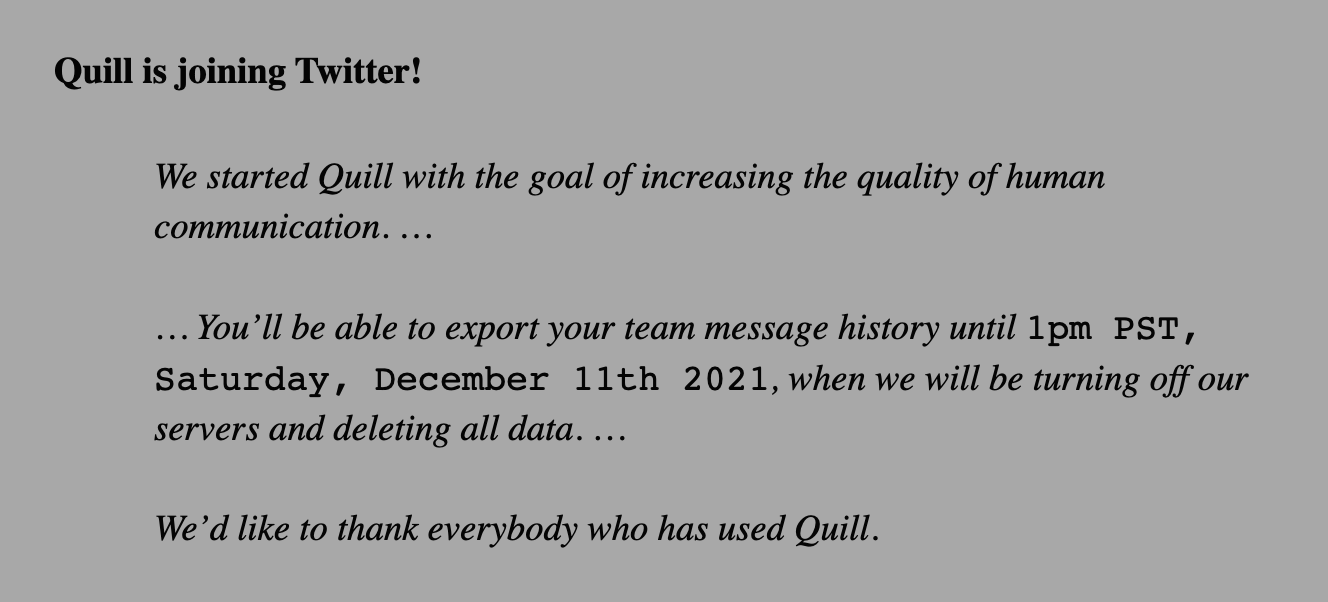

And customers get to read an article about “our incredible journey”, only to be shown the door afterwards:

There are hundreds of other examples of this. That’s crap. I don’t want to do that to our team and our customers.

Conclusion

I am not saying that it is generally wrong to work with investors. It should just be well thought out.

I wish that younger founders in particular would realize that working with investors is not the only way. That they understand that it is unfortunately a gamble with very little chance of success. And that they see that there are alternatives.

An alternative is to grow under our own steam as a “bootstrapped founder”. This is the path we have chosen in order to build the longest-lasting company possible.

We have an exist strategy, not an exit strategy.

Friendly in your inbox? Sign up for our newsletter.